| © 2022 Black Swan Telecom Journal | • | protecting and growing a robust communications business | • a service of | |

| Email a colleague |

March 2013

Meeting the OTT Video Challenge: Real-Time, Fine-Grain Bandwidth Monitoring for Cable Operators

I wonder how many tons of black ink (and electronic ink) have been spilled writing about how Over-the-Top (OTT) players are killing the mobile business.

Well, if you think mobile operators have got it bad, then consider the plight of the cable operators who are being overwhelmed by the surge in video and audio traffic.

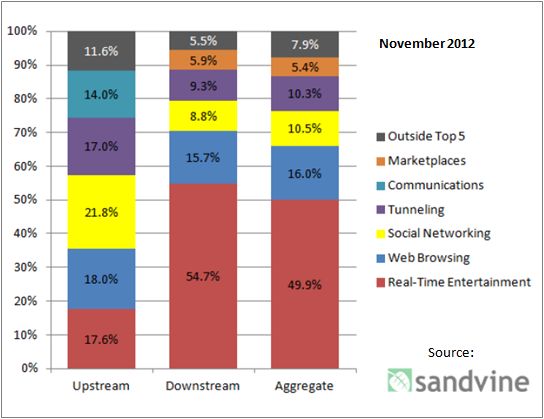

A recent “Global Internet Phenomena” report by DPI vendor Sandvine says that during peak time, 65 percent of all fixed-line data traffic in North America is delivered as audio- or video-streaming services. And one particular OTT, movie-streamer Netflix, accounts for a little over half of that traffic. All told, average monthly data usage in North America across wired connections has more than doubled from 23GB in 2011 to 51GB in 2012.

Peak Period Traffic Composition via Mobile Access

in North America

And it’s not just entertainment: a few weeks ago I repaired my refrigerator watching a step-by-step video from a company who sells appliance parts. The popularity of OTT applications like that is what’s caught the cable industry by surprise.

But help is here from a new and innovative provider, OpenVault, who monitors high-speed internet traffic from the cloud and makes it easy for Multi Service Operators (MSOs) to make critical decisions to protect quality of service and monetize their available bandwidth. Mark Trudeau, the company’s CEO, who gives some great perspective on this issue and other key trends in the cable industry, joins us now.

| Dan Baker: Mark, what’s your own perspective on the challenges cable operators face? What does your data tell you? |

Mark Trudeau: I think you framed the key issues, Dan. One thing our data confirms is that the usage spike is happening across the board. It’s not just the top 1% of users who are using more bandwidth — it’s everybody.

Another key trend we are seeing is a big growth in the number of devices per household. Households now have multiple iPads, an Xbox, or maybe internet-enabled TVs connected. All of those new devices are contributing to the spike in bandwidth consumption.

Put succinctly, the cable operators are no longer seeing their revenues directly aligned with their expenditures because of the proliferation of connected devices as well as OTT services.

It is not so much the device types we explore as it is the cumulative effect of the increasing number of devices and increasing number of bytes consumed/generated per device.

As it turns out, unknowingly, MSOs boxed themselves into a corner with these all-you-can-eat rate plans in the race to acquire HSD subscribers. Due to the unforeseen growth in data consumption you’re starting to see more usage-based billing offerings out there and enforcement of the Terms of Service that accompany them. In other words, they are going the way of wireless providers — charging the subscriber a fee whenever they go above an allowance or modifying their bandwidth when they reach their limits.

| Okay, interesting. My fast-internet provider is a rural operator called Blue Ridge Cable, and I don‘t believe they offer that quite yet. |

Sure, the smaller rural operators generally follow what big guys like Comcast and Cox roll out, so it is only a matter of time for you to personally experience it. Many of the big MSOs have announced usage-based billing packages, so we are starting to see the smaller operators catching the same train.

| Please tell us how your solution works. |

Well, our solution collects IPDR transported data generated by DOCSIS-compliant high-speed networks. That data is pushed to us every 15 minutes allowing us to see at a DOCSIS device level, the amount of upstream and downstream data consumption. We then enrich that data with other network traffic information and subscribed service contract parameters to tie actual network usage with financial responsibility. We track that throughout the course of a billing cycle and will know when a subscriber reaches their limit and then our solution will handle that situation based on what the operator wants to do at that point.

Some operators will throttle subscriber bandwidth speeds down to hopefully prevent them from using too much. Other operators will charge the customer once the subscriber goes over their limit. So there are various options depending on what the operators want to do from a business perspective, any of which our platform already supports.

| Was it a struggle to get the MSOs to agree to do this over the cloud? |

No. We haven‘t really had that problem. Certainly the larger operators like to host the data themselves and we’re flexible to accommodate that. But most of the small operators are willing to do this because number one, they don’t have space in their own data centers a lot of times, and frankly many of them love the flexibility of a software as a service model. So, it doesn‘t require any upfront licensing fee or anything like that, so they pay per subscriber per month. The SaaS approach really lowers the cost to get into this kind of technology.

I should also add that one of things that has made them more comfortable with SaaS is that we are not collecting personally identifiable information — or anything that could put them at risk in anyway. In fact, we have many security measures in place to protect them.

| What are the peak hours in the U.S. market for the spike in high-speed internet usage? |

Actually anywhere from 7 to 10 p.m. is the timeframe when the networks are at peak loads. And we’ve seen that remarkably consistent across operators.

Now a lot of operators look at the total year-over-year growth of usage consumption on their network, but that misses the point. They should really be looking at what’s going on during peak hours — how fast the peak usage is growing and which subscribers specifically are contributing to that growth.

That’s the real indicator of when and where they need to increase capacity. And analytics is key to measuring that. If I based my capacity plans on experiencing 40% year-over-year growth and the peak time period grew 60%, then I’ve vastly underestimated my capacity needs.

You can imagine what a challenge these dynamics are putting on MSOs.

You’re losing customers who are subscribing to premium services on one side of your business, who are, unfortunately for you, fulfilling their entertainment requirements by driving more data traffic on your HSD network, so you’ve got to figure out a way to grow new revenue streams.

Most of these operators have been experiencing flat revenues on the internet side of the business because their rate plans have been a consistent monthly recurring charge with no other incremental fees; meanwhile their costs to provide this service have been going up. That is not sustainable and has got to change.

| This business of real-time traffic analytics — where’s it likely to go from here? Can you expand your offering and provide other services to your base? |

Well, this highly granular monitoring of bandwidth is still very new for the operators, though they certainly know how to monitor network bandwidth at a high level.

So as our kind of solution becomes more mainstream, the operators are going to need to introduce new revenue generating products or usage-based billing types of things. Now the only way to offer the right product to the right customer is if you really understand the usage behavior on your network at a granular level.

So we are excited that numerous operators are starting to take advantage of the more granular usage intelligence we are providing. They will need to create new revenue-generating products — or, for operators who have congestion problems, they will use our data to manage bandwidth during peak time so that can provide a higher service quality to more subscribers during those hours.

For now, I think cable operators have all come to the conclusion that even if they haven‘t announced usage caps quite yet, they eventually will. And once they make decisions about what they are going to do, that’s when the market will open up to provide real-time rating and bandwidth management solutions.

| So policy management has some potential to grow in the future. |

There are many different aspects of policy, but as a general answer, “yes”. For instance, a very important capability is notifying subscribers when they reach certain thresholds of usage, via email for instance. Now that could lead to the operator doing various policy enforcement activities in the network such as limiting the ability to use too much of the network.

But before we get to that stage, there are other key things that need to be done.

For instance, educating the subscriber on what a gigabyte is and how many they routinely use. To accomplish that, we put up a subscriber usage meter for our operator customers. The subscriber can look at month-to-date usage and then some history of usage over the previous two or three months. Most operators go to that level; some provide daily information. We aggregate the every-15-minutes data we receive to the hourly level.

Going one step further, when a consumer calls to complain about being charged extra for high usage, there’s a challenge around justifying your bill. So we provide a portal for the customer care agent that shows the high speed internet usage for a particular subscriber during the previous month.

So if Grandma calls up to complain about a high usage charge on her internet bill, the customer care reps can point to a particular weekend, and suggest that maybe that’s when grandkids were visiting and using a Xbox or something. So providing more granular information like this allows customer care to better respond.

| What’s your feeling about these shared billing data plans such as Verizon Wireless has introduced? Can you foresee that type of model working in cable someday? |

You are comparing personal devices with premise devices. I do think shared plans make sense for the personalized wireless world. In the cable market, remember we are talking about a fixed DOCSIS network, and by default the family shares the pipe that comes into the house. Even still, we do see the concept of accounts with multiple cable modems on them, each subscribed to their own package and it is not a large step to combine the data for those multiple modems to support a shared data concept.

Still, more and more technologies are becoming available that will allow you to control bandwidth at the device level. So down the road we may see scenarios where an individual household and account holder has a lot of control over which devices are allocated bandwidth.

| What are the challenges the cable operators face as they move to more granular tracking and caps on usage? |

Well, one really important challenge is accuracy and reliability. As soon as you start billing for usage, you’re going to be challenged in terms of the accuracy of your usage levels that you are reporting on and billing on. So, that becomes a really critical piece of any solution that an operator puts in place because the last thing you need is bad press and a bunch of consumers complaining that they are being over-billed.

Since we view this accuracy issue as critical we had an audit done of our system by NetForecast, an independent auditor, the most well-known and respected auditor that’s out there. They confirmed the accuracy of our data collection and reporting in a report that’s available for anyone to see. We view this as a big differentiator versus other vendors and home-grown solutions.

So when we talk to potential customers, we kind of wave the accuracy flag and point out that if you plan to deploy usage limits and usage based billing, make sure to consider the accuracy factor because there’s a significant customer satisfaction, potential brand damage and revenue risk around that.

Copyright 2013 Black Swan Telecom Journal

Black Swan Solution Guides & Papers

- Expanding the Scope of Revenue Assurance Beyond Switch-to-Bill’s Vision — Araxxe — How Araxxe’s end-to-end revenue assurance complements switch-to-bill RA through telescope RA (external and partner data) and microscope RA (high-definition analysis of complex services like bundling and digital services).

- Lanck Telecom FMS: Voice Fraud Management as a Network Service on Demand — Lanck Telecom — A Guide to a new and unique on-demand network service enabling fraud-risky international voice traffic to be monitored (and either alerted or blocked) as that traffic is routed through a wholesaler on its way to its final destinations.

- SHAKEN / STIR Calling Number Verification & Fraud Alerting — iconectiv — SHAKEN/STIR is the telecom industry’s first step toward reviving trust in business telephony — and has recently launched in the U.S. market. This Solution Guide features commentary from technology leaders at iconetiv, a firm heavily involved in the development of SHAKEN.

- Getting Accurate, Up-to-the-Minute Phone Number Porting History & Carrier-of-Record Data to Verify Identity & Mitigate Account Takeovers — iconectiv — Learn about a recently approved risk intelligence service to receive authoritative and real-time notices of numbers being ported and changes to the carrier-of-record for specific telephone numbers.

- The Value of an Authoritative Database of Global Telephone Numbers — iconectiv — Learn about an authoritative database of allocated numbers and special number ranges in every country of the world. The expert explains how this database adds value to any FMS or fraud analyst team.

- The IPRN Database and its Use in IRSF & Wangiri Fraud Control — Yates Fraud Consulting — The IPRN Database is a powerful new tool for helping control IRSF and Wangiri frauds. The pioneer of the category explains the value and use of the IPRN Database in this 14-page Black Swan Solution Guide.

- A Real-Time Cloud Service to Protect the Enterprise PBX from IRSF Fraud — Oculeus — Learn how a new cloud-based solution developed by Oculeus, any enterprise can protect its PBX from IRSF fraud for as little as $5 a month.

- How Regulators can Lead the Fight Against International Bypass Fraud — LATRO Services — As a regulator in a country infected by SIM box fraud, what can you do to improve the situation? A white paper explains the steps you can and should you take — at the national government level — to better protect your country’s tax revenue, quality of communications, and national infrastructure.

- Telecom Identity Fraud 2020: A 36-Expert Analysis Report from TRI — TRI — TRI releases a new research report on telecom identity fraud and security. Black Swan readers can download a free Executive Summary of the Report.

- The 2021 State of Communications-Related Fraud, Identity Theft & Consumer Protection in the USA — iconectiv — This 49-page free Report on communications-related fraud analyzes the FTC’s annual Sentinel consumer fraud statistics and provides a sweeping view of trends and problem areas. It also gives a cross-industry view of the practices and systems that enable fraud control, identity verification, and security in our “zero trust” digital world.

cSwans of a Feather

- A Big Data Starter Kit in the Cloud: How Smaller Operators Can Get Rolling with Advanced Analytics — interview with Ryan Guthrie — Medium to small operators know “big data” is out there alright, but technical staffing and cost issues have held them back from implementing it. This interview discusses the advantages of moving advanced analytics to the cloud where operators can get up and running faster and at lower cost.

- Telecoms Failing Badly in CAPEX: The Desperate Need for Asset Management & Financial Visibility — interview with Ashwin Chalapathy — A 2012 PwC report put the telecom industry on the operating table, opened the patient up, and discovered a malignant cancer: poor network CAPEX management, a problem that puts telecoms in grave financial risk. In this interview, a supplier of network analytics solutions provides greater detail on the problem and lays out its prescription for deeper asset management, capacity planning and data integrity checks.

- History Repeats: The Big Data Revolution in Telecom Service Assurance — interview with Olav Tjelflaat — The lessons of telecom software history teach that new networks and unforeseen industry developments have an uncanny knack for disrupting business plans. A service assurance incumbent reveals its strategy for becoming a leader in the emerging network analytics and assurance market.

- From Alarms to Analytics: The Paradigm Shift in Service Assurance — interview with Kelvin Hall — In a telecom world with millions of smart devices, the service assurance solutions of yesteryear are not getting the job done. So alarm-heavy assurance is now shifting to big data solutions that deliver visual, multi-layered, and fine-grained views of network issues. A data architect who works at large carriers provides an inside view of the key service provider problems driving this analytics shift.

- The Shrink-Wrapped Search Engine: Why It’s Becoming a Vital Tool in Telecom Analytics — interview with Tapan Bhatt — Google invented low cost, big data computing with its distributed search engine that lives in mammoth data centers populated with thousands of commodity CPUs and disks. Now search engine technology is available as “shrink wrapped” enterprise software. This article explains how this new technology is solving telecom analytics problems large and small.

- Harvesting Big Data Riches in Retailer Partnering, Actionable CEM & Network Optimization — interview with Oded Ringer — In the analytics market there’s plenty of room for small solution firms to add value through a turnkey service or cloud/licensed solution. But what about large services firms: where do they play? In this article you’ll learn how a global services giant leverages data of different types to help telcos: monetize retail partnerships, optimize networks, and make CEM actionable.

- Raising a Telco’s Value in the Digital Ecosystem: One Use Case at a Time — interview with Jonathon Gordon — The speed of telecom innovation is forcing software vendors to radically adapt and transform their business models. This article shows how a deep packet inspection company has expanded into revenue generation, particularly for mobile operators. It offers a broad palette of value-adding use cases from video caching and parental controls to application-charging and DDoS security protection.

- Radio Access Network Data: Why It’s Become An Immensely Useful Analytics Source — interview with Neil Coleman — It’s hard to overstate the importance of Radio Access Network (RAN) analytics to a mobile operator’s business these days. This article explains why the RAN data, which lives in the air interface between the base station and the handset -- can be used for a business benefit in network optimization and customer experience.

- Analytics Biology: The Power of Evolving to New Data Sources and Intelligence Gathering Methods — interview with Paul Morrissey — Data warehouses create great value, yet it’s now time to let loose non-traditional big data platforms that create value in countless pockets of operational efficiency that have yet to be fully explored. This article explains why telecoms must expand their analytics horizons and bring on all sorts of new data sources and novel intelligence gathering techniques.

- Connecting B/OSS Silos and Linking Revenue Analytics with the Customer Experience — by Anssi Tauriainen — Customer experience analytics is a complex task that flexes B/OSS data to link the customer’s network experience and actions to improve it and drive greater revenue. In this article, you’ll gain an understanding of how anayltics data needs to be managed across various customer life cycle stages and why it’s tailored for six specific user groups at the operator.

- Meeting the OTT Video Challenge: Real-Time, Fine-Grain Bandwidth Monitoring for Cable Operators — interview with Mark Trudeau — Cable operators in North America are being overwhelmed by the surge in video and audio traffic. In this article you’ll learn how Multi Service Operators (MSOs) are now monitoring their traffic to make critical decisions to protect QoS service and monetize bandwidth. Also featured is expert perspective on trends in: network policy; bandwidth caps; and customer care issues.

- LTE Analytics: Learning New Rules in Real-Time Network Intelligence, Roaming and Customer Assurance — interview with Martin Guilfoyle — LTE is telecom’s latest technology darling, and this article goes beyond the network jargon, to explain the momentous changes LTE brings. The interview delves into the marriage of IMS, high QoS service delivery via IPX, real-time intelligence and roaming services, plus the new customer assurance hooks that LTE enables.

Related Articles

- Tokopedia, Indonesia’s E-Commerce King, Partners with 11 Million Merchants; Adopts Multi-Cloud to Drive Innovation — interview with Warren Aw & Ryan de Melo — Indonesia’s Tokopedia, founded in 2009, has grown to become one of world’s leading e-commerce players. Read about its success, technology direction, and multi-cloud connectivity adoption.

- Bridge Alliance: Knocking Down Regional & Mobile Connectivity Barriers so Connected Car Markets Get Rolling in Asia — interview with Kwee Kchwee — The CEO of an Asian consortium of mobile operators explains how they help simplify and harmonize their members‘ operations in support of multi-national corporations. This integration is enabling two huge industries to come together in Asia: auto manufacturing and telco.

- Epsilon’s Infiny NaaS Platform Brings Global Connection, Agility & Fast Provision for IoT, Clouds & Enterprises in Southeast Asia, China & Beyond — interview with Warren Aw — Network as a Service, powered by Software Defined Networks, are a faster, more agile, and more partner-friendly way of making data global connections. A leading NaaS provider explains the benefits for cloud apps, enterprise IT, and IoT.

- PCCW Global: On Leveraging Global IoT Connectivity to Create Mission Critical Use Cases for Enterprises — interview with Craig Price — A leading wholesale executive explains the business challenges of the current global IoT scene as it spans many spheres: technical, political, marketing, and enterprise customer value creation.

- Senet’s Cloud & Shared Gateways Drive LoRaWAN IoT Adoption for Enterprise Businesses, Smart Cities & Telecoms — interview with Bruce Chatterley — An IoT netowork pioneer explains how LoRaWAN tech fits in the larger IoT ecosystem. He gives use case examples, describes deployment restraints/costs, and shows how partnering, gateway sharing, and flexible deployment options are stimulating growth.

- ARM Data Center Software’s Cloud-Based Network Inventory Links Network, Operations, Billing, Sales & CRM to One Database — interview with Joe McDermott & Frank McDermott — A firm offering a cloud-based network inventory system explains the virtues of: a single underlying database, flexible conversions, task-checking workflow, new software business models, views that identify stranded assets, and connecting to Microsoft’s cloud platform.

- Pure Play NFV: Lessons Learned from Masergy’s Virtual Deployment for a Global Enterprise — interview with Prayson Pate — NFV is just getting off the ground, but one cloud provider to enterprises making a stir in virtual technology waters is Masergy. Here are lessons learned from Masergy’s recent global deployment using a NFV pure play software approach.

- The Digital Enabler: A Charging, Self-Care & Marketing Platform at the Core of the Mobile Business — interview with Jennifer Kyriakakis — The digital enabler is a central platform that ties together charging, self-care, and marketing. The article explains why leading operators consider digital enablers pivotal to their digital strategies.

- Delivering Service Assurance Excellence at a Reduced Operating Cost — interview with Gregg Hara — The great diversity and complexity of today’s networks make service assurance a big challenge. But advances in off-the-shelf software now permit the configuring and visualizing of services across multiple technologies on a modest operating budget.

- Are Cloud-Based Call Centers the Next Hot Product for the SMB Market? — interview with Doron Dovrat — Quality customer service can improve a company’s corporate identity and drive business growth. But many SMBs are priced out of acquiring modern call center technology. This article explains the benefits of affordable and flexible cloud-based call centers.

- Flexing the OSS & Network to Support the Digital Ecosystem — interview with Ken Dilbeck — The need for telecoms to support a broader digital ecosystem requires an enormous change to OSS infrastructures and the way networks are being managed. This interview sheds light on these challenges.

- Crossing the Rubicon: Is it Time for Tier Ones to Move to a Real-Time Analytics BSS? — interview with Andy Tiller — Will tier one operators continue to maintain their quilt works of legacy and adjunct platforms — or will they radically transform their BSS architecture into a new system designed to address the new telecom era? An advocate for radical transformation discusses: real-time analytics, billing for enterprises, partnering mashups, and on-going transformation work at Telenor.

- Paradigm Shift in OSS Software: Network Topology Views via Enterprise-Search — interview with Benedict Enweani — Enterprise-search is a wildly successful technology on the web, yet its influence has not yet rippled to the IT main stream. But now a large Middle Eastern operator has deployed a major service assurance application using enterprise-search. The interview discusses this multi-dimensional topology solution and compares it to traditional network inventory.

- The Multi-Vendor MPLS: Enabling Tier 2 and 3 Telecoms to Offer World-Class Networks to SMBs — interview with Prabhu Ramachandran — MPLS is a networking technology that has caught fire in the last decade. Yet the complexity of MPLS has relegated to being mostly a large carrier solution. Now a developer of a multi-vendor MPLS solutions explains why the next wave of MPLS adoption will come from tier 2/3 carriers supporting SMB customers.

- Enabling Telecoms & Utilities to Adapt to the Winds of Business Change — interview with Kirill Rechter — Billing is in the midst of momentous change. Its value is no longer just around delivering multi-play services or sophisticated rating. In this article you’ll learn how a billing/CRM supplier has adapted to the times by offering deeper value around the larger business issues of its telecom and utility clients.

- Driving Customer Care Results & Cost Savings from Big Data Facts — interview with Brian Jurutka — Mobile broadband and today’s dizzying array of app and network technology present a big challenge to customer care. In fact, care agents have a hard time staying one step ahead of customers who call to report problems. But network analytics comes to the rescue with advanced mobile handset troubleshooting and an ability to put greater intelligence at the fingertips of highly trained reps.

- Hadoop and M2M Meet Device and Network Management Systems — interview with Eric Wegner — Telecom big-data in networks is more than customer experience managment: it’s also about M2M plus network and element management systems. This interview discusses the explosion in machine-to-machine devices, the virtues and drawbacks of Hadoop, and the network impact of shrink-wrapped search.

- The Data Center & Cloud Infrastructure Boom: Is Your Sales/Engineering Team Equipped to Win? — by Dan Baker — The build-out of enterprise clouds and data centers is a golden opportunity for systems integrators, carriers, and cloud providers. But the firms who win this business will have sales and engineering teams who can drive an effective and streamlined requirements-to-design-to-order process. This white paper points to a solution — a collaborative solution designs system — and explains 8 key capabilities of an ideal platform.

- Big Data: Is it Ready for Prime Time in Customer Experience Management? — interview with Thomas Sutter — Customer experience management is one of the most challenging of OSS domains and some suppliers are touting “big data” solutions as the silver bullet for CEM upgrades and consolidation. This interview challenges the readiness of big data soluions to tackle OSS issues and deliver the cost savings. The article also provides advice on managing technology risks, software vendor partnering, and the strategies of different OSS suppliers.

- Calculated Risk: The Race to Deliver the Next Generation of LTE Service Management — interview with Edoardo Rizzi — LTE and the emerging heterogeneous networks are likely to shake up the service management and customer experience management worlds. Learn about the many new network management challenges LTE presents, and how a small OSS software firm aims to beat the big established players to market with a bold new technology and strategy.

- Decom Dilemma: Why Tearing Down Networks is Often Harder than Deploying Them — interview with Dan Hays — For every new 4G LTE and IP-based infrastructure deployed, there typically a legacy network that’s been rendered obsolete and needs to be decommissioned. This article takes you through the many complexities of network decom, such as facilities planning, site lease terminations, green-safe equipment disposal, and tax relief programs.

- Migration Success or Migraine Headache: Why Upfront Planning is Key to Network Decom — interview with Ron Angner — Shutting down old networks and migrating customers to new ones is among the most challenging activities a network operators does today. This article provides advice on the many network issues surrounding migration and decommissioning. Topics discussed include inventory reconciliation, LEC/CLEC coordination, and protection of customers in the midst of projects that require great program management skills.

- Navigating the Telecom Solutions Wilderness: Advice from Some Veteran Mountaineers — interview with Al Brisard — Telecom solutions vendors struggle mightily to position their solutions and figure out what to offer next in a market where there’s considerable product and service crossover. In this article, a veteran order management specialist firm lays out its strategy for mixing deep-bench functional expertise with process consulting, analytics, and custom API development.

- Will Telecoms Sink Under the Weight of their Bloated and Out-of-Control Product Stacks? — interview with Simon Muderack — Telecoms pay daily for their lack of product integration as they constantly reinvent product wheels, lose customer intelligence, and waste time/money. This article makes the case of an enterprise product catalog. Drawing on central catalog cases at a few Tier 1 operators, the article explains the benefits: reducing billing and provisioning costs, promoting product reuse, and smoothing operations.

- Virtual Operator Life: Enabling Multi-Level Resellers Through an Active Product Catalog — interview with Rob Hill — The value of product distribution via virtual operators is immense. They enable a carrier to sell to markets it cannot profitably serve directly. Yet the need for greater reseller flexibility in the bundling and pricing of increasingly complex IP and cloud services is now a major channel barrier. This article explains what’s behind an innovative product catalog solution that doubles as a service creation environment for resellers in multiple tiers.

- Telecom Blocking & Tackling: Executing the Fundamentals of the Order-to-Bill Process — interview with Ron Angner — Just as football teams need to be good at the basics of blocking and tackling, telecoms need to excel at their own fundamental skillset: the order-to-cash process. In this article, a leading consulting firm explains its methodology for taking operators on the path towards order-to-cash excellence. Issues discussed include: provisioning intervals; standardization and simplicity; the transition from legacy to improved process; and the major role that industry metrics play.

- Wireline Act IV, Scene II: Packaging Network & SaaS Services Together to Serve SMBs — by John Frame — As revenue from telephony services has steadily declined, fixed network operators have scrambled to support VoIP, enhanced IP services, and now cloud applications. This shift has also brought challenges to the provisioning software vendors who support the operators. In this interview, a leading supplier explains how it’s transforming from plain ol‘ OSS software provider to packager of on-net and SaaS solutions from an array of third party cloud providers.

- Telecom Merger Juggling Act: How to Convert the Back Office and Keep Customers and Investors Happy at the Same Time — interview with Curtis Mills — Billing and OSS conversions as the result of a merger are a risky activity as evidenced by famous cases at Fairpoint and Hawaiian Telcom. This article offers advice on how to head off problems by monitoring key operations checkpoints, asking the right questions, and leading with a proven conversion methodology.

- Is Order Management a Provisioning System or Your Best Salesperson? — by John Konczal — Order management as a differentiator is a very new concept to many CSP people, but it’s become a very real sales booster in many industries. Using electronics retailer BestBuy as an example, the article points to several innovations that can — and are — being applied by CSPs today. The article concludes with 8 key questions an operator should ask to measure advanced order management progress.

- NEC Takes the Telecom Cloud from PowerPoint to Live Customers — interview with Shinya Kukita — In the cloud computing world, it’s a long road from technology success to telecom busness opportunity. But this story about how NEC and Telefonica are partnering to offer cloud services to small and medium enterprises shows the experience of early cloud adoption. Issues discussed in the article include: customer types, cloud application varieties, geographic region acceptance, and selling challenges.

- Billing As Enabler for the Next Killer Business Model — interview with Scott Swartz — Facebook, cloud services, and Google Ads are examples of innovative business models that demand unique or non-standard billing techniques. The article shows how flexible, change-on-the-fly, and metadata-driven billing architectures are enabling CSPs to offer truly ground breaking services.

- Real-Time Provisioning of SIM Cards: A Boon to GSM Operators — interview with Simo Isomaki — Software-controlled SIM card configuration is revolutionizing the activation of GSM phones. The article explains how dynamic SIM management decouples the selection of numbers/services and delivers new opportunities to market during the customer acquisition and intial provisoining phase.

- A Cynic Converted: IN/Prepaid Platforms Are Now Pretty Cool — interview with Grant Lenahan — Service delivery platforms born in the IN era are often painted as inflexible and expensive to maintain. Learn how modern SDPs with protocol mediation, high availability, and flexible Service Creation Environments are delivering value for operators such as Brazil’s Oi.

- Achieving Revenue Maximization in the Telecom Contact Center — interview with Robert Lamb — Optimizing the contact center offers one of the greatest returns on investment for a CSP. The director of AT&T’s contact center services business explains how telecoms can strike an “artful balance” between contact center investment and cost savings. The discussion draws from AT&T’s consulting with world class customers like Ford, Dell, Discover Financial, DISH Network, and General Motors.

- Mobile Broadband: The Customer Service Assurance Challenge — interview with Michele Campriani — iPhone and Android traffic is surging but operators struggle with network congestion and dropping ARPUs. The answer? Direct resources and service quality measures to ensure VIPs are indeed getting the quality they expect. Using real-life examples that cut to the chase of technical complexities, this article explains the chief causes of service quality degradation and describes efficient ways to deal with the problem.

- Telco-in-a-Box: Are Telecoms Back in the B/OSS Business? — interview with Jim Dunlap — Most telecoms have long since folded their merchant B/OSS software/services businesses. But now Cycle30, a subsidiary of Alaskan operator GCI, is offering a order-to-cash managed service for other operators and utilities. The article discusses the company’s unique business model and contrasts it with billing service bureau and licensed software approaches.

- Bricks, Mortar & Well-Trained Reps Make a Comeback in Customer Management — interview with Scott Kohlman — Greater industry competition, service complexity, and employee turnover have raised the bar in the customer support. Indeed, complex services are putting an emphasis on quality care interactions in the store, on the web, and through the call center. In this article you’ll learn about innovations in CRM, multi-tabbed agent portals, call center agent training, customer treatment philosophies, and the impact of self-service.

- 21st Century Order Management: The Cross-Channel Sales Conversation — by John Konczal — Selling a mobile service is generally not a one-and-done transaction. It often involves several interactions — across the web, call center, store, and even kiosks. This article explains the power of a “cross-channel hub” which sits above all sales channels, interacts with them all, and allows a CSP to keep the sales conversation moving forward seamlessly.

- Building a B/OSS Business Through Common Sense Customer Service — by David West — Delivering customer service excellence doesn‘t require mastering some secret technique. The premise of this article is that plain dealing with customers and employees is all that’s needed for a winning formula. The argument is spelling out in a simple 4 step methodology along with some practical examples.