| © 2022 Black Swan Telecom Journal | • | protecting and growing a robust communications business | • a service of | |

| Email a colleague |

April 2019

Big Data without the Database: SIGOS Delivers Purpose-Built Analytics for Mobile Money, Fraud Control & Assurance

Sweet are the uses of adversity.

Even as the winter’s wind bites and blows upon my body

And I shrink from the cold, I smile and say:

“This is no flattery: these are counsellors

That feelingly persuade me what I am.“

The toad, ugly and venomous,

Wears yet a precious jewel in his head.

Shakespeare, As You Like It (1623) adapted

Managing adversity is a way of life in the digital business. It’s a leapfrog game where victory or defeat is often decided by who gets a technological jump on its rivals.

Fortunately the rules of the game are well understood: it’s nothing more than the human application of Mother Nature’s law: survival of the fittest.

Another lesson: “it’s not wise for small-and weak animals to enter the territory of the big-and-strong.” Mighty frogs like Oracle, AT&T, or Amdocs can roam a wide territory and oversee great lakes, but they rarely settle down near out-of-the-way ponds or soft streams.

Opportunities abound for small-and-weak frogs, so long as they choose their niches carefully. The habitat should be rich in nourishing grubs, spiders, and snails. And it’s best to pick a somewhat secluded spot that doesn’t attract too much attention.

But sooner or later all digital frogs — large and small — must seek out new habitats because markets move quickly and have a short life.

Two years ago, SIGOS, one of the most skillful and nimble players on the fraud and assurance scene, faced such a dilemma. It had a large and impressive test call business and it led the market in SIM Box fraud control. Still does.

SIGOS saw storm clouds ahead. In certain developing markets, it noticed SIM box bypass was now under control. And with the rise of smartphones, WhatsApp, and Skype, it foresaw a time when mobile operator profits would be less dependent on international voice.

So to drive new business and strengthen its current ones, SIGOS embarked on a radical change in the way it does its analytics.

SIGOS’s new strategy is the subject of my conversation with Kenneth Mouton, head of the firm’s Revenue Assurance & Fraud Management business unit.

Kenneth gives us a fascinating look on the SIGOS Analytics managed service that leverages purpose-built solutions across many fraud/RA cases. Major developments on its SIM Box solution are also discussed as well as details on SIGOS’s hottest new analytics case, Mobile Money.

| Dan Baker, Editor, Black Swan: Kenneth, following SIGOS over the last few years, I’ve always considered you to be in the test call business, but I understand you’re evolving your business with a new platform. |

Kenneth Mouton: It’s true, Dan. Today we are far more focused on analytics solutions, and our test call strong suit remains an important part of the story.

Our approach to analytics is quite different from the big revenue assurance players like Subex and WeDo.

Traditional analytics is about delivering a software product that the telecom runs to process its CDRs and detect all possible flavors of fraud and internal process errors. And, of course, it’s built with a nice GUI and case tool for the telecom’s fraud or RA analyst.

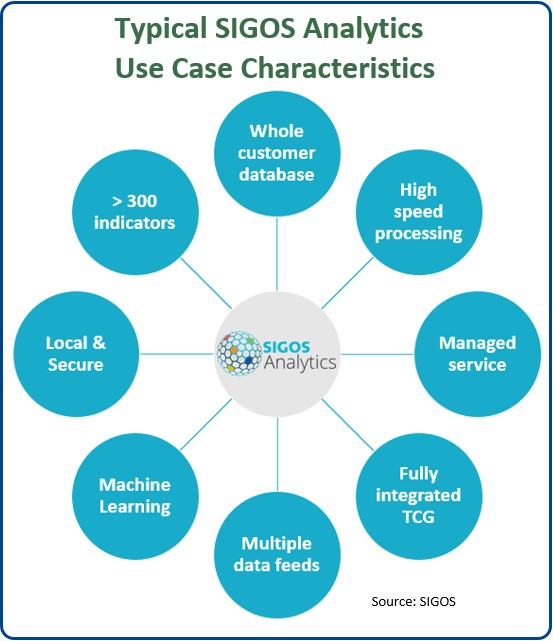

But our analytics thrust is based on a “purpose-built” platform. The emphasis is on speed and profiling high volumes of data fast for a limited number of use cases. Also unique, we are only delivering this as a fully managed service. Our approach simplifies the task somewhat. For instance, we don’t need to maintain legacy code or tweak functionality and GUIs for customers.

We ask our customers to give us access to data, such as CDRs from the switch, and we then decode those ourselves and maintain a series of profiles. And we consider CDR processing as only one data input among many. For instance, integration with our test call results is very valuable in interconnect use cases.

We use Facebook’s RocksDB to process hundreds of millions of CDR a day, updating hundreds of millions of profiles with zero delay. We have not come across any similar solution so far.

| Can you give us an example how you deploy this single-purpose solution? |

Think about the country of Nigeria with 200 million subscribers. What we do there with every CDR that is generated is update the involved subscribers’ profiles. Each profile has hundreds of indicators such as “% international calls last week” or “kb of data consumed today”. So in Nigeria we keep 200 million of these profiles entirely up to date.

Now it’s important to note: we do not keep the CDRs ourselves. We just process them and update the profile for each subscriber. And then we can quickly make decisions on those profiles.

Our algorithms and some machine learning make decisions in a purpose-built way. So if the application is SIM Box fraud, it can only do that. But because it’s a single purpose platform, it does its analysis very fast — within seconds.

Now even though its mission is only one type of fraud, for what it does, it’s the best on the market because it’s superfast and carries only the features that are necessary.

| It’s interesting. Your single-purpose system, then, is really a new approach to “big data” analytics. |

It is. And it’s a bit hard to explain because when people use the term “big data”, they think about databases where you query lots of data. And our system is not a database.

We don’t keep the call records, we just process them to update the profiles, and it’s the profiles we keep. There’s no history we keep, so there’s no querying to do.

But the advantage of processing this way is our system can beat any Multi-Purpose system very easily at the use cases that we cover.

When you are designing something for a very specific purpose, you can architect the technical design in a novel and very efficient way, whereas in a traditional big data system you’re always looking over your shoulder at what other uses you may need to accommodate.

| Would you call it a cloud-based solution? |

SIGOS has many cloud solutions, but this Analytics platform is not. The problem with cloud for us is that too many telcos don’t want to have their CDRs leave the country.

We could install it in the cloud, but what we normally do is install the system at the operator’s site, say a server located in the core network of our customers. The beauty of this is we avoid many security and privacy concerns.

And having a platform so close to the network also contributes to lightning fast speed. Remember, it takes time to analyze and upload things to the cloud.

So that’s our strategy at SIGOS — to build things where we can out-perform everybody in the market. To solve very specific problems. We are fighting the ambition to be all things to all people.

| What dedicated cases do you support with this kind of system? |

Well, today SIGOS Analytics supports multiple modules: Hybrid Revenue Assurance, SIM Box, Refiling, Mobile Money, Traffic Reporting & Alarming, SMS Fraud, and Revenue Assurance CDR Mediation.

To give you an example of how versatile the platform is, consider the dedicated Traffic Reporting module we released last year.

It monitors traffic increases and decreases. For example, if a customer sees a drop in inbound roamers from Verizon US, we can automatically raise an alert on that and send automated emails out. In this case we profile per country, operator, service, trunk... not per subscriber.

Now our competitors don’t have such a platform because it requires a purpose-built design to aggregate all the data for traffic reporting and do complex cross-tabulations in an efficient way.

All mobile operators have traffic monitoring tools and are skeptical when we want to showcase our product, but, Dan, all are impressed once they see it, especially by the speed of our dashboards and the ease of configuration. Our Analytics platform uses SIGOS’ latest WebUI and comes with SIGOS fully flexible alarming capabilities — features we have been developing and improving for more than 20 years now.

Another great example is our Hybrid Revenue Assurance. Everybody knows our Active Revenue Assurance test call product. This testing ensures the billing and metering is fully accurate. Our Analytics platform now adds completeness to this accuracy. It will aggregate all raw CDR and all rated CDR and compare the total number of transactions, minutes... ensuring the customer that nothing gets lost in “switch-to-bill”. This hybrid approach is much more cost-efficient compared to full suite passive Revenue Assurance systems.

| Kenneth, in our last interview you spoke about your innovations in the SIM Box fraud fight, particularly the “stealth mode” where you temporarily redirect a call to millions of real, active subscriber phone numbers so fraudsters can never identify which are test calls. |

Actually we are the company (SIGOS/Meucci) who invented the SIM Box fraud solution and we’re still the most advanced and complete. Today, I think, there are three points of competitive differentiation.

- SIM Box Test Calls: The stealth mode has turned the tables on the fraudster

because we’ve taken away their ability to detect our test calls.

It’s counter-measure- and corruption-proof. SIGOS invented this

method and we have patents pending on the process in several key countries.

Now the latest enhancement in our SIM Box Detection test call system is greater automation. Sunday morning for example we find that none of our colleagues is working, but our test call system will automatically identify and launch the most efficient and effective test call schedule anyway.

That 24/7 automated approach seems obvious, but some pretty complicated development went on behind the scenes. - SIM Box CDR Profiling: As I mentioned, our Analytics platform is very

fast and covers not just CDRs, but also other data sources such as activation

dates, top-up vouchers, and others. It is fully integrated with the test

calls.

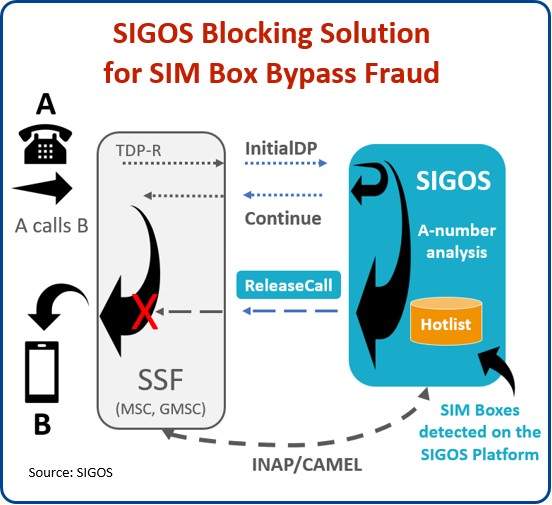

As CDR profiling and Test calls have opposing advantages and disadvantages, the sum is more than its parts. We always say 1+1=3. - SIM Box Blocking is a brand new capability. We scan all incoming traffic

and immediately block all calls coming from competitor (offnet) SIM Boxes.

Imagine Nigeria again where they process millions of calls a day. Our solution analyzes all incoming calls. From the moment a call is made from the thousands of unique SIM Boxes identified in Nigeria, we block the call.

Having this capability is a major step forward for SIGOS. We are no longer in the business of detecting SIM Boxes, we are now in the business of stopping SIM Boxes.

When you add it all up, none of our competitors has the complete package we have in SIM Box detection and blocking today.

| When all’s said and done, are there actual cases of countries in Africa or elsewhere where SIM Box bypass has actually been stopped? |

Yes, in many countries we are successful at stopping SIM box fraud. And I have some testimonials on that subject as well.

But to get the job done, the operator must invest in the whole solution: test calls, CDR profiling, and blocking. And they have to control their sales channels, an internal process.

Honestly, most of our customers are struggling. They decrease the fraud or they stop growing it, but they don’t solve the issue.

Only a minority of our customers have mastered the art of completely eradicating SIM Box fraud. In many cases it is also a budget issue. Many customers still think a $10,000 solution will eradicate a $1,000,000 problem. They end up disappointed.

| You mentioned Mobile Money as a growth opportunity you’re pursuing. What’s that market about? Quite a few solution vendors have tried to break into that. Then again, few people in the RA/fraud solution business have as much experience as you have on the African continent where the action is. |

Dan, if you surf the GSMA website, you’ll see there’s great interest in Mobile Money. Some published figures say the market is growing 25% a year in revenue and 30% in new subscribers.

But to really recognize the opportunities, you need to experience it yourself. Safaricom’s Mobile Money is by far the biggest bank in Kenya. And if you go to Kenya, you’ll discover that everything is paid using Mobile Money. Their bread, their beer. Everything.

The government pays their retirement plans and pensions using Mobile Money. Taxes are paid by Mobile Money. You can’t imagine the scale of Mobile Money.

It’s become a huge thing, because everybody has a mobile phone, but people generally do not have identity cards, bank accounts or access to ATM machines.

And you can’t limit it to Africa. The biggest mobile money markets today are in places like Pakistan, Bangladesh and India. Every place in the developing world, mobile operators are succeeding as financial institutions. They are even giving loans using Mobile Money.

| So how is SIGOS participating? |

We have a complete suite of solutions to manage Mobile Money concerns.

One case we manage is fraud detection. Fraud occurs for example when an employee at the mobile operator diverts funds where they shouldn’t go. Or when an agent abuses commission schemes. Mobile Money processes and regulations are different in each country — even at each operator — so the exceptions are quite varied.

We also do revenue assurance for mobile money, checking whether the billing and metering works correctly.

My SIGOS colleagues from the Quality of Service and Quality of Experience business unit are managing the service assurance side of Mobile Money. For instance, did all the SMS confirmation messages get through? How fast is the Cash Out transaction? And so forth.

| Kenneth, congratulations on your continued success in the SIM Box fight and your exciting move into Mobile Money. Of course, much of these wins come on heels of your intriguing analytics approach. |

Thanks, Dan.

I think our leadership in the SIM Box area has been strengthened by perfecting our Stealth Mode and bolting on full Analytics and 100% blocking of calls for every illegal SIM Box detected.

Now, in any market we pursue these days, our goal is to be the performance leader. And with our dedicated, high performance, network-embedded Analytics platform I think we can achieve that.

And don’t get me wrong. Companies such as Subex or WeDo do many things with their platforms that we cannot do. We have never seen them as rivals but as complementary to our solutions and we want to keep it that way.

Of course, that means we must also be very selective about the analytics markets we go after. And that is exactly what we are doing.

Copyright 2019 Black Swan Telecom Journal

Black Swan Solution Guides & Papers

- Expanding the Scope of Revenue Assurance Beyond Switch-to-Bill’s Vision — Araxxe — How Araxxe’s end-to-end revenue assurance complements switch-to-bill RA through telescope RA (external and partner data) and microscope RA (high-definition analysis of complex services like bundling and digital services).

- Lanck Telecom FMS: Voice Fraud Management as a Network Service on Demand — Lanck Telecom — A Guide to a new and unique on-demand network service enabling fraud-risky international voice traffic to be monitored (and either alerted or blocked) as that traffic is routed through a wholesaler on its way to its final destinations.

- SHAKEN / STIR Calling Number Verification & Fraud Alerting — iconectiv — SHAKEN/STIR is the telecom industry’s first step toward reviving trust in business telephony — and has recently launched in the U.S. market. This Solution Guide features commentary from technology leaders at iconetiv, a firm heavily involved in the development of SHAKEN.

- Getting Accurate, Up-to-the-Minute Phone Number Porting History & Carrier-of-Record Data to Verify Identity & Mitigate Account Takeovers — iconectiv — Learn about a recently approved risk intelligence service to receive authoritative and real-time notices of numbers being ported and changes to the carrier-of-record for specific telephone numbers.

- The Value of an Authoritative Database of Global Telephone Numbers — iconectiv — Learn about an authoritative database of allocated numbers and special number ranges in every country of the world. The expert explains how this database adds value to any FMS or fraud analyst team.

- The IPRN Database and its Use in IRSF & Wangiri Fraud Control — Yates Fraud Consulting — The IPRN Database is a powerful new tool for helping control IRSF and Wangiri frauds. The pioneer of the category explains the value and use of the IPRN Database in this 14-page Black Swan Solution Guide.

- A Real-Time Cloud Service to Protect the Enterprise PBX from IRSF Fraud — Oculeus — Learn how a new cloud-based solution developed by Oculeus, any enterprise can protect its PBX from IRSF fraud for as little as $5 a month.

- How Regulators can Lead the Fight Against International Bypass Fraud — LATRO Services — As a regulator in a country infected by SIM box fraud, what can you do to improve the situation? A white paper explains the steps you can and should you take — at the national government level — to better protect your country’s tax revenue, quality of communications, and national infrastructure.

- Telecom Identity Fraud 2020: A 36-Expert Analysis Report from TRI — TRI — TRI releases a new research report on telecom identity fraud and security. Black Swan readers can download a free Executive Summary of the Report.

- The 2021 State of Communications-Related Fraud, Identity Theft & Consumer Protection in the USA — iconectiv — This 49-page free Report on communications-related fraud analyzes the FTC’s annual Sentinel consumer fraud statistics and provides a sweeping view of trends and problem areas. It also gives a cross-industry view of the practices and systems that enable fraud control, identity verification, and security in our “zero trust” digital world.

Recent Stories

- Epsilon’s Infiny NaaS Platform Brings Global Connection, Agility & Fast Provision for IoT, Clouds & Enterprises in Southeast Asia, China & Beyond — interview with Warren Aw , Epsilon

- PCCW Global: On Leveraging Global IoT Connectivity to Create Mission Critical Use Cases for Enterprises — interview with Craig Price , PCCW Global

- Subex Explains its IoT Security Research Methods: From Malware & Coding Analysis to Distribution & Bad Actor Tracking — interview with Kiran Zachariah , Subex

- Mobile Security Leverage: MNOs to Tool up with Distributed Security Services for Globally-Connected, Mission Critical IoT — interview with Jimmy Jones , Positive Technologies

- TEOCO Brings Bottom Line Savings & Efficiency to Inter-Carrier Billing and Accounting with Machine Learning & Contract Scanning — interview with Jacob Howell , TEOCO

- PRISM Report on IPRN Trends 2020: An Analysis of the Destinations Fraudsters Use in IRSF & Wangiri Attacks — interview with Colin Yates , Yates Consulting

- Telecom Identity Fraud 2020: A 36-Expert Analyst Report on Subscription Fraud, Identity, KYC and Security — by Dan Baker , TRI

- Tackling Telecoms Subscription Fraud in a Digital World — interview with Mel Prescott & Andy Procter , FICO

- How an Energized Antifraud System with SLAs & Revenue Share is Powering Business Growth at Wholesaler iBASIS — interview with Malick Aissi , iBASIS

- Mobileum Tackles Subscription Fraud and ID Spoofing with Machine Learning that is Explainable — interview with Carlos Martins , Mobileum