| © 2022 Black Swan Telecom Journal | • | protecting and growing a robust communications business | • a service of | |

| Email a colleague |

August 2020

LATRO’s Tips for Launching a Successful Revenue & Fraud Assurance Program for Mobile Money Operations in Developing Countries

Mobile money is not only a great telecom service for the unbanked people of the world, it’s also a differentiating telecom service that the world’s giants in banking and OTTs find hard to compete against.

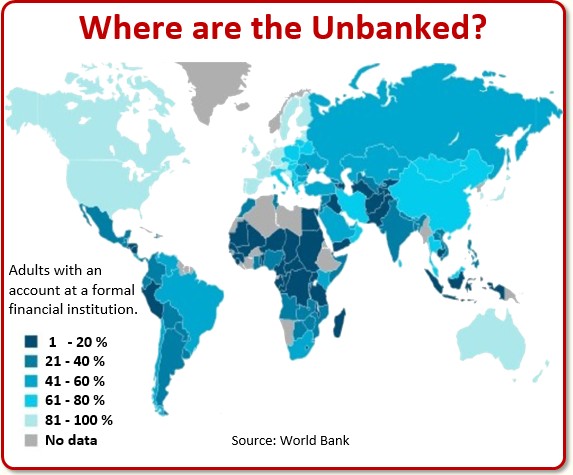

The World Bank chart below shows the huge mobile money commercial opportunities that lie across Africa, South Asia, Southeast Asia, South America, and Central America — essentially the tropical countries of the world, including countries like India and Indonesia with giant populations.

Where mobile money will succeed is in countries where substantial banking, credit, and broadband infrastructure don’t exist. For instance, even though the unbanked population of the United States is about 21 million people (6.5% of population), firms like Walmart are serving this market well by issuing debit cards that are backed up by a major bank.

However in countries with a high percentage of unbanked community, cash access and other financial services are severely restricted — and that’s a place where mobile money can deliver great value. Those countries also lack high smartphone, broadband, and PC penetration, so people don’t have the GUI interface capability to manage their money as they can with a smartphone. However people can still use mobile money because the service can be used on non-smartphones.

Now along with this opportunity, Revenue Assurance (RA) pros face the sudden prospect of providing secondary controls for money transfer operations with strict identity checking and bank-like accounting sophistication. So how on Earth do you make the leap from assuring telecom services to banking services?

Well, it requires special training and software tools. One company stepping into the fray is LATRO Services, a 12 year veteran of fraud control, and a company who’s now building mobile money RAFM tools and offering related managed services.

Here to provide their expertise on this hot new risk service are LATRO’s COO, Don Reinhart, and Asem Abughazaleh, head of revenue assurance and mobile money product management. Together they deliver a splendid backgrounder for the Mobile Money business and tips on closing the RAFM gap.

| Dan Baker, Editor, Black Swan Telecom Journal: Don, for the past several years, I’ve known LATRO for your fraud management specialty, particularly in developing countries infected with SIM box bypass problems. So I’m curious what prompted this move into mobile money revenue assurance. |

Don Reinhart: Dan, over the past two years we’ve been broadening our portfolio. And revenue assurance is a natural area of expansion for us. Actually, at many of our mobile operator customers, the person responsible for fraud and revenue assurance is the same person.

Plus we recognize that revenue assurance is now in high demand as mobile money takes off and has a positive effect in countries where a huge part of the population deal only with cash — and banking services are not available.

Most of the time the controls for mobile money fall within the revenue assurance bucket, but the mobile money business is generally treated as a special unit in the telecom business.

Since mobile money is not a traditional communications service, many telecom professionals are a bit intimidated by it. Mobile money is very financially and compliance driven, which means there’s a lot of liability and risk around it. Hence, telecom bureaucrats tend to shy away from those risks.

But somebody needs to step up, so this is why the local revenue assurance team is usually the one tasked with putting local controls around the mobile money system, ensuring compliance with central bank policies and regulations in combating fraud, money laundering and terrorist financing.

| We should emphasize the revenue assurance team is not responsible for primary control over mobile money. |

Yes, that’s correct. The people running the mobile money platform — within the operator — have their own controls in place to check the system to detect system errors and money laundering.

Assurance’s job is secondary controls, much like how traditional RA oversees billing and provisioning systems. The whole philosophy of revenue assurance is to assure that all the primary controls are in place — that the business is correctly monitoring potential leakage points and identifying problems in the primary systems.

| Before we go further discussing revenue assurance for mobile money, it would be great to get a backgrounder on the mobile money business and ecosystem. |

Fine, Dan. You’ll recall in the webinar you attended that my colleague, Asem Abughazaleh, who heads up our revenue assurance and mobile money product management, gave an introductory talk on mobile money, so we’ve included the transcript of his discussion below with some diagrams from his presentation.

The Origins of Mobile Money

Mobile Money (MoMo) is a technology that allows people to receive, store and spend money using a mobile phone. More than 270 different mobile money services exist around the world today.

It was first implemented by Vodafone’s Kenyan operator, Safaricom, through a system branded as M-PESA, which has since become a huge national success story. The two founders of the mobile money business were Nick Hughes of the Vodafone Group and Michael Joseph of Safaricom.

Today mobile money goes by many names: e-wallet, mobile-wallet, M-PESA, Airtel-Money and many more. It is most popular in Africa, Asia and Latin America.

The M-PESA Success Story

When the M-PESA MoMo system was launched in March 2007, it was targeted at low-income consumers with no or limited access to conventional banking & financial services.

The original money-making idea was for M-PESA to enable micro-loans. But when the service was launched, the service took off as a low cost means of P2P money transfer — and that use case continues to be the main driver of success.

Currently, M-PESA is launched in 7 countries, with over 37 million active customers and almost 400,000 active agents.

M-PESA has a tremendous impact on the countries where it has been launched. It has significantly reduced the potential risks of street robbery. In many countries, walking around with cash in your pocket is very dangerous.

The service also reduced corruption and enabled businesses of all sizes to collect payments from customers.

It also helped governments collect taxes and disburse social security payments. Charities and non-government organizations were also able to send money to thousands of beneficiaries at once.

The Main Actors in a Mobile Money Ecosystem

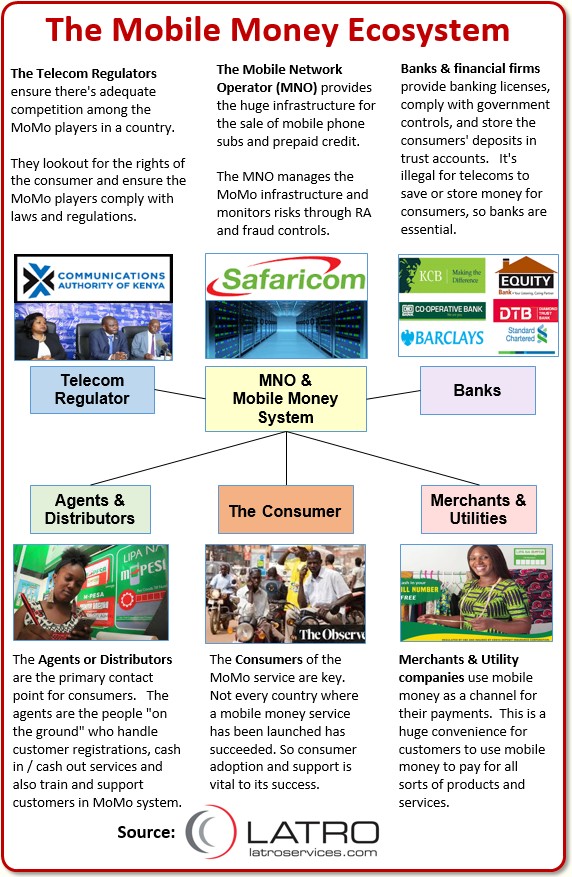

Using the M-PESA mobile money system as an example, we created a chart below explaining the main actors who make up a typical mobile money system:

- The Mobile Network Operator provides the infrastructure and the huge

existing distribution channels used for the sale of phones, top-ups, subscriptions,

and prepaid credit. No other company in these mobile money countries has

that broad a network of people and devices to draw on. The MNO manages

the MoMo infrastructure and monitors risks through RA and fraud controls.

- Banks and financial institutions are also key to providing necessary

banking license, ensure government compliance, and the ability to store the

mobile money consumers’ deposits in trust accounts. In general,

the telecom operators are not allowed by law to save or store money for consumers,

so the banks enable that.

- Distribution Channels or Agents provide the people on the ground —

the primary contact point for consumers. Agents handle customer registrations,

cash-in / cash-out services and also train and support customers in the MoMo

system.

- Merchants & Utility companies use mobile money as a channel for their

payments. This is a huge convenience. Customers get to use mobile

money services to pay for all kinds of products and services

- Regulators ensure there’s adequate competition among the MoMo players.

They look out for the rights of the consumer and enforce the MoMo players to

comply with laws and regulations.

- Finally, the Consumers of the MoMo service are very important. Not

every country where a MoMo service launched has been successful. So consumer

adoption and support is vital to its success.

Mobile Money Transactions

To show how the mobile money actors relate to one another, here’s a brief explanation of 5 common consumer transactions.

- Customers register for the service at an authorized agent, by filling an application

form.

- The agent verifies the customer’s ID and uses his special SIM card to

register the customer on the MNO m-commerce platform.

- The m-commerce platform creates an account and mobile wallet on the server and

sends confirmation message to customer.

- Customers visit an authorized agent and deposits cash.

- The agent uses his special SIM card to transfer the e-value to the customer

mobile wallet on the MNO m-commerce platform.

- The m-commerce platform send messages to the customer and the agent to confirm

the transaction.

- Customer A uses the interface provided by the MNO to request balance transfer

(it could be via SMS, USSD or an App).

- From the menu provided in the interface, the customer select the amount and

the recipient (Customer B).

- The m-commerce platform send messages to the sender and recipient to confirm

the transaction.

- Customers visit a merchant that accepts MoMo payments.

- Customer uses the interface provided by the MNO to pay for the goods (via SMS,

USSD or an App).

- The m-commerce platform send messages to the customer and the merchant to confirm

the transaction.

- Customers visit an authorized agent and request for Cash-out.

- The agent uses his special SIM card to request the deduction of the value from

customer mobile wallet via the MNO m-commerce platform.

- The m-commerce platform send messages to the customer and the agent to confirm

the transaction.

- The agent hands over the money to the customer.

| Many thanks to Asem for providing this clear and concise presentation on mobile money operations. So let’s now get into the revenue assurance side. What are the high level goals of mobile money RA capabilities and controls? |

Don Reinhart: Dan, it’s all about risk mitigation. Once a telecom offers a mobile money service, they become a financial institution in many ways themselves.

They need to handle the transactions from subscribers to the banks, so that becomes a major liability to the telco. So having the following risk capabilities is vital:

- Real-time advanced analytics, data insights and assurance on mobile money,

e-wallets, mobile savings, mobile insurance, and mobile credits.

- 360 Degree View of Fund Flows between all participating stake holders

to help the business take measures to assure revenue.

- Platform Agnostic ability to Re-compute and Reconcile all transactions

(e.g. it needs to support all mobile money transaction platforms like Airtel

money, M-PESA, ECW etc.)

- Agent Commission calculation capability to ensure their accuracy.

- The ability to generate Banking Compliance and Anti-Money Laundering (AML)

Reports and to enable the business user to configure and automate those

reports.

And here are some of the checks and balances LATRO recommends for mobile money RA:

- Rating Validation to ensure the accuracy of service charges and commission

payouts.

- Monitoring Accounts, to identity suspicious things. For example,

there should never be a negative balance in an e-wallet.

- Monitor transactions in suspended/terminated accounts. In one case

we know of, there was an internal fraud case where one of the operator employees

used a terminated account to access the system and withdrew a lot of money illegally

before fleeing the country the next day.

- Make sure the MoMo Financially Balances across the many parties in

the ecosystem.

- Monitor and report any Failed Bank Transactions.

- Do Identity Integrity Checks to reconcile subscribers present on

MoMo platform as compared with the HLR, CRM and/or Billing systems.

| What about fraud controls? |

Fraud monitoring is very important as well. Though we can’t reveal any public cases at this point, having the right controls in place is definitely key to preventing insider fraud from happening.

Certainly the leading cause of fraud in mobile money is due to SIM swap. In fact, the same security vulnerabilities inherent in GSM since the 1990s continue to be there. So detecting SIM swap is a vital capability for fraud-assuring mobile money.

The SIM card in the phone acts as both the account number and the wallet on the mobile money service. So whenever fraudster can get a SIM card, they can transfer the money to their account. Passwords offer some protection. The problem is: the fraudster can reset the SIM card, so we have to monitor that.

Some top fraud controls include:

- Check for high count of PIN Resets for specific accounts per day regarding

SIM swaps.

- Check for any suspicious Customer Registration Info Changes.

- Check to ensure transactions don’t go beyond allowable limits using TEMP/TEST,

the test lines provided to operators’ employees for internal testing for

MoMo service, offers and promotions.

- Anti-Money Laundering Controls (over 265 rules are proposed for AML validations)

- Agent/dealer Commission and Fake Activation fraud. These are schemes

where the agent tries to increase its transactions to collect more commissions.

- Subscription Fraud (ensure no dummy names are used, such as same

name with different IDs, or vice versa).

| How did you enable your clients in central Asia to actually launch MoMo? What were the main steps in the LATRO implementation process? |

Well, it’s about putting in the controls prior to launch. At the outset, we worked with the client and developed a risk catalog — showing the risks for mobile money service.

Then we defined processes to control those risks. We also customized a software product for them, then trained them on how to use it to get their revenue assurance capability successfully launched.

Once the MoMo service was operating, we fine-tuned the processes. Later on we enabled them to better analyze their transaction logs and develop rules to highlight certain problems or unusual activities to check in the system.

Perhaps the biggest challenge is instilling the knowledge to operate the system correctly. This requires our experts — those who understand how the mobile money ecosystem works — to show what transaction flow looks like and create analysis rules that identify errors, problems, or unusual activity in the transaction data.

Apart from the innovative solution that involves near real-time analytics and dashboards, LATRO also offers Managed Services to clients. If the operator doesn’t have local expertise available to assure mobile money, LATRO will provide those resources. We perform the professional services and help implement the control framework based on our experience at other clients.

| Don, thanks for this excellent introduction to mobile money with ideas for RAFM experts need to think about as they plan their mobile money controls. With your more than 50 customers and strong base in developing countries, sounds like mobile money RAFM is a nice fit for LATRO. |

Thanks, Dan. Yes, we’re very excited about the roll out of our mobile money assurance business. Demand is picking up and we’ve got the solutions they need.

I want to underscore the kind of mobile money solution we bring to clients is highly tailored and configured to the local operation. This is not a one-size-fit-all solution. It’s very much a DIY (Do It Yourself) approach where the local team customizes the reports and controls for the local situation which is bound to be quite different across countries.

We’re also thrilled that we’re helping bring to life a service that does a lot of good in the world. Mobile brings much needed financial control and consumer protection in regions of the world where local corruption is often pretty high.

An interesting story: one of our mobile operator clients was implementing the same mobile money system as SafariCom. It was adopted by a local public law enforcement agency for payroll disbursement. And when it came time to pay employees through the new MoMo system, one of the key areas it impacted was the direct payment of the police officers.

It seems prior to mobile money, the way police got paid was the head of the police would get a box full of cash to distribute down to his lieutenants and further levels down the chain before the money reached the policemen on the street.

Well, the way the corruption exists there, money was being skimmed off the top at each level of distribution. By the time the lowest police officer got paid, it wasn’t much money at all.

But when mobile money was launched, this corruption was circumvented and the low level policemen were startled how much money they “earned” compared to the prior system.

Well, LATRO has worked closely with police departments over the years as we identify the location of illegal SIM box operations enabling the police to make raids and arrest the culprits.

So it’s nice to think that our mobile money RAFM may now benefit out friends in law enforcement in a more personal way.

Copyright 2020 Black Swan Telecom Journal

Black Swan Solution Guides & Papers

- Expanding the Scope of Revenue Assurance Beyond Switch-to-Bill’s Vision — Araxxe — How Araxxe’s end-to-end revenue assurance complements switch-to-bill RA through telescope RA (external and partner data) and microscope RA (high-definition analysis of complex services like bundling and digital services).

- Lanck Telecom FMS: Voice Fraud Management as a Network Service on Demand — Lanck Telecom — A Guide to a new and unique on-demand network service enabling fraud-risky international voice traffic to be monitored (and either alerted or blocked) as that traffic is routed through a wholesaler on its way to its final destinations.

- SHAKEN / STIR Calling Number Verification & Fraud Alerting — iconectiv — SHAKEN/STIR is the telecom industry’s first step toward reviving trust in business telephony — and has recently launched in the U.S. market. This Solution Guide features commentary from technology leaders at iconetiv, a firm heavily involved in the development of SHAKEN.

- Getting Accurate, Up-to-the-Minute Phone Number Porting History & Carrier-of-Record Data to Verify Identity & Mitigate Account Takeovers — iconectiv — Learn about a recently approved risk intelligence service to receive authoritative and real-time notices of numbers being ported and changes to the carrier-of-record for specific telephone numbers.

- The Value of an Authoritative Database of Global Telephone Numbers — iconectiv — Learn about an authoritative database of allocated numbers and special number ranges in every country of the world. The expert explains how this database adds value to any FMS or fraud analyst team.

- The IPRN Database and its Use in IRSF & Wangiri Fraud Control — Yates Fraud Consulting — The IPRN Database is a powerful new tool for helping control IRSF and Wangiri frauds. The pioneer of the category explains the value and use of the IPRN Database in this 14-page Black Swan Solution Guide.

- A Real-Time Cloud Service to Protect the Enterprise PBX from IRSF Fraud — Oculeus — Learn how a new cloud-based solution developed by Oculeus, any enterprise can protect its PBX from IRSF fraud for as little as $5 a month.

- How Regulators can Lead the Fight Against International Bypass Fraud — LATRO Services — As a regulator in a country infected by SIM box fraud, what can you do to improve the situation? A white paper explains the steps you can and should you take — at the national government level — to better protect your country’s tax revenue, quality of communications, and national infrastructure.

- Telecom Identity Fraud 2020: A 36-Expert Analysis Report from TRI — TRI — TRI releases a new research report on telecom identity fraud and security. Black Swan readers can download a free Executive Summary of the Report.

- The 2021 State of Communications-Related Fraud, Identity Theft & Consumer Protection in the USA — iconectiv — This 49-page free Report on communications-related fraud analyzes the FTC’s annual Sentinel consumer fraud statistics and provides a sweeping view of trends and problem areas. It also gives a cross-industry view of the practices and systems that enable fraud control, identity verification, and security in our “zero trust” digital world.

Recent Stories

- Epsilon’s Infiny NaaS Platform Brings Global Connection, Agility & Fast Provision for IoT, Clouds & Enterprises in Southeast Asia, China & Beyond — interview with Warren Aw , Epsilon

- PCCW Global: On Leveraging Global IoT Connectivity to Create Mission Critical Use Cases for Enterprises — interview with Craig Price , PCCW Global

- Subex Explains its IoT Security Research Methods: From Malware & Coding Analysis to Distribution & Bad Actor Tracking — interview with Kiran Zachariah , Subex

- Mobile Security Leverage: MNOs to Tool up with Distributed Security Services for Globally-Connected, Mission Critical IoT — interview with Jimmy Jones , Positive Technologies

- TEOCO Brings Bottom Line Savings & Efficiency to Inter-Carrier Billing and Accounting with Machine Learning & Contract Scanning — interview with Jacob Howell , TEOCO

- PRISM Report on IPRN Trends 2020: An Analysis of the Destinations Fraudsters Use in IRSF & Wangiri Attacks — interview with Colin Yates , Yates Consulting

- Telecom Identity Fraud 2020: A 36-Expert Analyst Report on Subscription Fraud, Identity, KYC and Security — by Dan Baker , TRI

- Tackling Telecoms Subscription Fraud in a Digital World — interview with Mel Prescott & Andy Procter , FICO

- How an Energized Antifraud System with SLAs & Revenue Share is Powering Business Growth at Wholesaler iBASIS — interview with Malick Aissi , iBASIS

- Mobileum Tackles Subscription Fraud and ID Spoofing with Machine Learning that is Explainable — interview with Carlos Martins , Mobileum